Bookkeeping is vital for the success of a construction business. While construction companies are experts in creating impressive infrastructures, managing financial records can be challenging. Embracing digital tools for bookkeeping can greatly improve efficiency and accuracy. Effective bookkeeping practices ensure that your construction company stays financially stable and prospers.

In this article, we’ll cover the top ten essential bookkeeping tips for construction companies, equipping you with the tools to streamline your accounting processes and make informed financial decisions.

Elevate Efficiency, Simplify Success with Premium Cridix Bookkeeping Services!

Freshops management services

Bookkeeping Tips for Construction Companies

Running a successful construction company requires a strong foundation, and that foundation extends to your financial management. Unlike some industries, construction bookkeeping has its own set of challenges due to project-based work, fluctuating costs, and multiple contracts. However, with the right strategies and tools, efficient bookkeeping can enhance accuracy, streamline processes, and ensure financial stability. Here are essential bookkeeping tips for construction companies to keep your construction company’s finances in order:

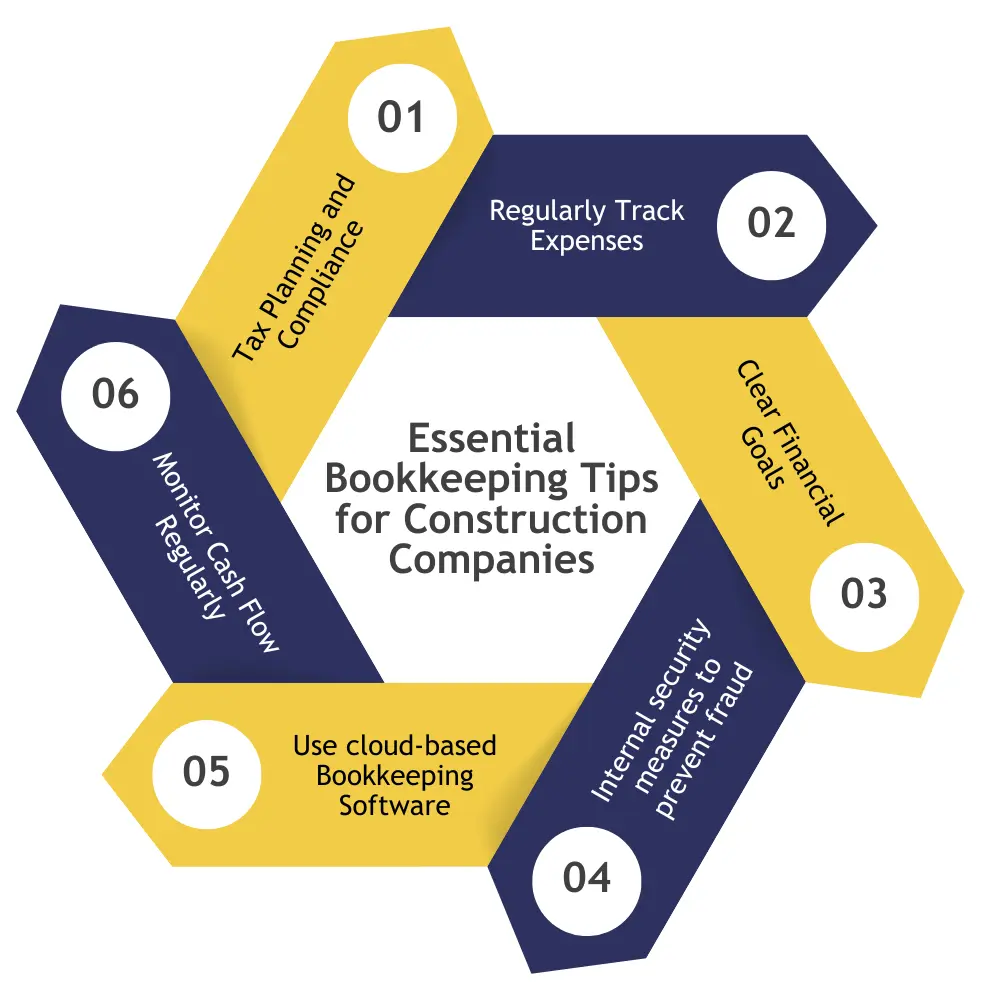

Essential Bookkeeping Tips for Construction Companies

Regularly Track Expenses

Choose a method that works for you, whether receipts in a designated folder, a mobile app for scanning receipts, or integrating your expense tracking with your Bookkeeping Software. Track direct costs like materials, labor, equipment rentals, and permits.

Don’t forget indirect costs like office supplies, utilities, insurance, and professional fees. Organize your expenses into relevant categories like materials, labor, subcontractors, equipment, etc. This allows for easier analysis of project profitability and helps with budgeting for future projects.

Clear Financial Goals

What do you want to achieve financially? Do you want to increase profit margins? Quantify your goals so you can track progress. For example, instead of just “increase profitability”, aim for a specific percentage increase in profit margin for each project. Tailor your bookkeeping practices to provide the financial insights you need to achieve your goals. For instance, focus on job costing reports if you want to improve project profitability.

Use cloud-based Bookkeeping Software

Explore options that to the specific needs of construction companies. Look for features like job costing, project management integration, payroll processing, and mobile access. Cloud-based software can automate repetitive tasks like data entry, invoice generation, and bank reconciliation. This frees up your time for more strategic activities.

It makes it easy to access your financial data from anywhere with an internet connection. This allows for better financial decision-making and improved collaboration with your team and outside professionals.

Internal security measures to prevent fraud

Avoid having one person handle all aspects of the financial process, like recording purchases, approving payments, and reconciling bank statements. Require two signatures for high-value transactions or checks. Schedule regular internal reviews of financial statements and transaction logs to identify any discrepancies or suspicious activity.

Implement a Bookkeeping System

Develop a documented system outlining how you handle financial transactions. This includes procedures for recording invoices, managing payroll, paying bills, and generating financial reports. Establish a clear and consistent chart of accounts to categorize your income and expenses.

Monitor Cash Flow Regularly

Maintain a clear understanding of your cash flow by regularly monitoring incoming and outgoing funds. This includes customer payments, vendor invoices, loan payments, and payroll expenses. By analyzing your cash flow, you can anticipate potential shortfalls and take proactive measures to manage them.

Tax Planning and Compliance

Construction companies face a unique set of tax rules. Consult with a tax professional or accountant to ensure you understand your tax obligations. Work with your accountant to develop a tax plan that minimizes your tax liabilities and maximizes your tax deductions. Maintain accurate and up-to-date records of all your income and expenses throughout the year. This makes tax filing much smoother and helps to avoid penalties for non.

Collaborate with Professional Bookkeepers

As your business grows, consider partnering with a Bookkeeper who understands the construction industry. They can offer valuable insights on industry best practices, tax regulations, and financial strategies. Free up your time by delegating routine bookkeeping tasks like data entry, reconciliation, and payroll processing to a qualified professional. Leverage the expertise of a bookkeeper to develop financial reports and forecasts that help you make informed business decisions.

Best Software for a construction company bookkeeping

Choosing the right Bookkeeping Software is crucial for a construction company. Here we discuss three popular options highlighting their strengths and suitability for construction services:

Top Software for a construction company bookkeeping

XERO: Xero is a solid choice for smaller construction companies or those new to cloud-based bookkeeping. Its user-friendly interface makes it easy to learn, and its mobile app is convenient for tracking expenses and managing finances remotely. However, Xero might lack some advanced features needed by larger construction companies, such as robust job costing tools or extensive project management integration.

Quickbooks: QuickBooks offers a strong suite of features for construction companies, including job costing, progress billing, and project management tools. There are different versions available, with QuickBooks Online being a good option for smaller firms, and QuickBooks Enterprise catering to larger companies with more complex needs.

Sage Intacct: Sage Intacct is a powerful and comprehensive solution ideal for large construction companies with complex financial needs. It offers advanced job costing, project management, and budgeting tools. However, Sage Intacct comes at a higher cost compared to Xero and QuickBooks, and its feature-rich environment may be overwhelming for smaller companies.

Have you heard of Cridix Bookkeeping?

We understand the unique challenges construction companies face. Our Accounting & Bookkeeping Services are tailored to keep your projects on track and finances in order.

Let us handle the details so you can focus on what matters most – Building Success.

conclusion For Bookkeeping Tips for Construction Companies

In conclusion, implementing strong financial practices is essential for any construction company’s success. By following these eight key Bookkeeping tips for Construction Companies, you can gain control over your finances, make informed business decisions, and ensure the long-term health of your company. Remember, a well-defined bookkeeping system combined with the right software and professional guidance can significantly improve your financial visibility, streamline operations, and ultimately contribute to building a more profitable and thriving construction business.