Introduction to the Impacts of Bad Bookkeeping

In 2025, with businesses facing tough competition, managing finances well is crucial for keeping a company afloat and helping it thrive. Bookkeeping, which is keeping track of money coming in and going out, is super important for this. But if bookkeeping isn’t done right, it can mess up how well a business does, causing a lot of problems.

Ineffective bookkeeping can adversely impact your business, regardless of its profitability. Beyond missed opportunities, it can lead to increased operating expenses and potentially expose you to legal liabilities.

Premium Bookkeeping Services with Cridix

Cridix offers you effective Bookkeeping Services, our professional Bookkeeping

experts ensure accurate bookkeeping, tax compliance, regular reconciliation, and financial optimization, empowering Business owners to focus on development.

In this article, we’ll explore the impacts of bad bookkeeping can be harmful to your business’s financial records, like balance sheets and profit and loss statements, and how it can hold back your business growth. Understanding the importance of poor accounting practices helps you to make informed decisions and uphold proper financial record-keeping. Various factors of your business operations can suffer from bad bookkeeping.

WHEN BOOKKEEPING TURN INTO A PROBLEM?

Bookkeeping can become a problem when it’s not done accurately or consistently. This might happen when transactions are not recorded properly when there are discrepancies between records, or when financial data is not updated regularly. Essentially, bookkeeping turns into a problem when it fails to provide reliable and up-to-date information about a company’s financial situation.

In summary, bookkeeping becomes problematic when there are errors, inconsistencies, delays, or inadequacies in recording and updating financial data. This compromises the reliability and usefulness of the information for decision-making and can have negative consequences for the company’s financial management and performance.

With Cridix Premium Services, CPA firms and other small Businesses can streamline their financial operations, ensuring Accuracy, Compliance, and Efficiency.

Accounting serves as a cornerstone for eCommerce businesses by facilitating financial management, ensuring regulatory compliance, and guiding strategic decision-making processes. Ultimately, it fosters efficiency, profitability, and sustainable growth within the eCommerce landscape.

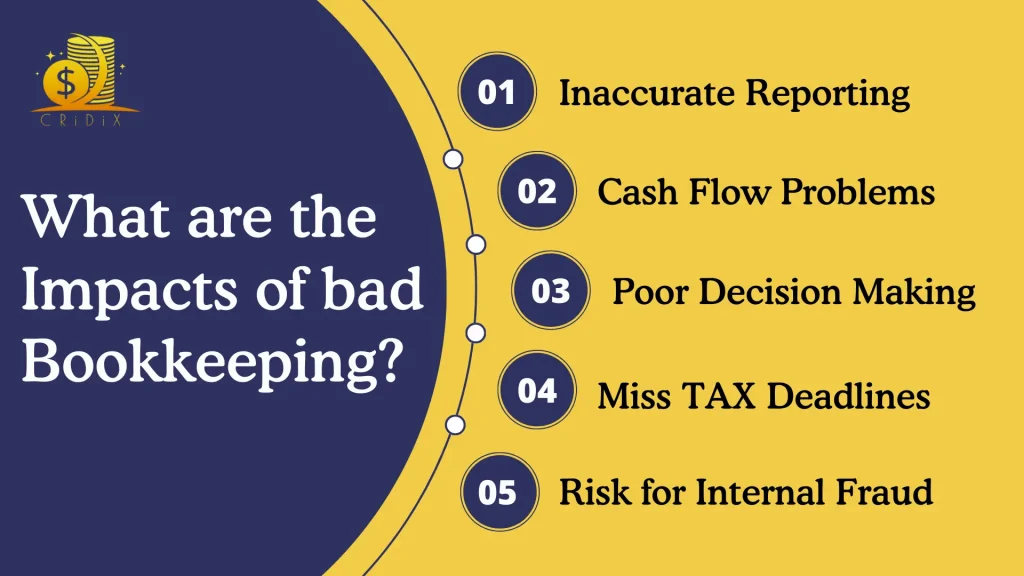

Impacts of bad Bookkeeping

Poor bookkeeping can have serious consequences for businesses, Impacts of bad Bookkeeping lead to inaccurate reporting, tax problems, revenue loss, expense misjudgment, cash flow issues, internal fraud risk, and invoicing mistakes. These problems arise when financial records are not maintained accurately or consistently. Incorrect reporting can mislead decision-making, leading to tax errors and revenue loss.

Misjudging expenses can affect cost management, while cash flow problems stem from delayed or inaccurate transaction recording. Inadequate controls also increase the risk of fraud. Invoicing mistakes can cause payment delays and disputes with clients. Overall, poor bookkeeping jeopardizes financial health and integrity.

Inaccurate Reporting

Inaccurate reporting is the main factor that has an impact on bad bookkeeping which can have severe implications for businesses. When financial records are not maintained accurately or consistently, reporting errors can arise, leading to misinformation and misinterpretation of the company’s financial health. This can mislead decision-making processes, causing businesses to allocate resources inefficiently or make strategic errors.

If You Don’t Know Your Numbers, means you’re unaware of your Business’s performance

Inaccurate reporting can also result in regulatory compliance issues, as financial statements may not comply with accounting standards or regulatory requirements. Ultimately, inaccurate reporting undermines the credibility of the business’s financial information, eroding stakeholder trust and potentially damaging the company’s reputation.

Cash Flow Problems

Cash flow problems are a significant consequence of bad bookkeeping practices. When financial records are not maintained accurately or updated regularly, it can lead to discrepancies in cash flow management. Delayed or inaccurate recording of transactions can cover the true cash position of the business, making it challenging to monitor incoming and outgoing funds effectively. As a result, businesses may struggle to meet financial commitments such as paying suppliers or employees on time, leading to strained relationships and potential disruptions in operations.

82% of U.S. businesses fail due to cash flow problems!

Poor bookkeeping means missing out on crucial aspects related to cash flow management. For instance, you may lack visibility into accounts payable and receivable, struggle with inefficient invoice management, or have limited clarity regarding your company’s financial statements.

Tax Problems

Poor bookkeeping can lead to tax problems for businesses. When financial records are not accurately maintained or updated, it can result in errors in tax filings. This can lead to underpayment or overpayment of taxes, which may attract penalties, fines, or audits from tax authorities.

Additionally, insufficient documentation or improper categorization of expenses can raise red flags during tax audits, further complicating the situation for the business. Ultimately, tax problems arising from bad bookkeeping practices can result in financial losses and legal liabilities for the company.

Tax time becomes a major headache when you have poor Bookkeepers

Risk for Internal Fraud

Bad bookkeeping practices increase the risk of internal fraud within the company. When financial records are inaccurate or poorly maintained, it creates opportunities for employees to manipulate or misappropriate funds without detection. Without proper checks and balances in place, such as regular reconciliation of accounts and oversight of financial transactions, fraudulent activities can go unnoticed for extended periods. This not only leads to financial losses for the company but also damages trust and morale among employees.

8 Best Ways to Manage Small Business Financial Management

Overall, poor bookkeeping heightens the risk of internal fraud, posing a significant threat to the integrity and financial health of the business.

Poor Decision Making

Poor bookkeeping results in low-quality financial information, including cash flow statements, profit/loss, and balance sheets. This undermines the reliability of your decisions, which may have consumed considerable time and effort. Accurate bookkeeping, on the other hand, ensures timely and error-free financial reports, instilling confidence in your numbers and enabling informed decisions aligned with your business objectives.

What are the Benefits Of Hiring an Accountant?

So when financial records are accurate, it’s easy for business leaders to make informed choices. Without reliable financial data, decisions may be based on guesswork rather than facts, leading to suboptimal outcomes and hindering business growth.

5 Ways You Can Improve Bookkeeping

Effective bookkeeping is essential for maintaining financial stability and making informed decisions in any business. By implementing strategies to improve bookkeeping practices, businesses can ensure accuracy, efficiency, and compliance with regulatory standards.

Here are some ways you can enhance your bookkeeping:

Taking professional support can provide businesses with expertise, efficiency, accuracy, compliance, financial planning, customized solutions, access to networks, and peace of mind. Whether it’s Outsourcing Bookkeeping tasks, hiring a Tax Accountant, or consulting with a Financial Advisor, leveraging professional support can help businesses optimize their financial management processes and achieve long-term success.

Outsourced Bookkeeping Services

Why Choose Cridix Accountancy for Bookkeeping Services

Choose Cridix Accountancy for expert bookkeeping services tailored to your business. Our experienced team ensures accuracy, efficiency, and compliance in managing your financial records. With personalized support, we help you make informed decisions, allowing you to focus on growing your business with confidence. Trust Cridix Accountancy for precise and reliable bookkeeping solutions.

Personalized Support, Informed Decisions: Cridix Accountancy!

Want to know more About us?

Conclusion

The impacts of bad bookkeeping on your business can be deep and destructive. From inaccurate financial reporting to cash flow problems and increased risk of fraud, inadequate bookkeeping practices can hinder the growth and success of your business. It undermines financial transparency, decision-making processes, and overall operational efficiency.

Therefore, prioritizing proper bookkeeping procedures and investing in accurate record-keeping is essential for maintaining financial health, regulatory compliance, and long-term sustainability. By recognizing the importance of good bookkeeping practices and taking proactive steps to address any shortcomings, businesses can mitigate risks and position themselves for success in today’s competitive landscape.

With our extensive expertise in eCommerce Accounting and Bookkeeping, we’re committed to fulfilling your requirements. If you have any further inquiries, please visit our website or reach out to us directly at Whatsapp +19295603456 or via email at info@cridix.com.