Introduction to Outsourcing Accounting Services for Small Business

In today’s dynamic world of small businesses, entrepreneurs have to manage various tasks, handling everything from daily tasks to long-term growth plans. This can leave crucial aspects like accounting feeling neglected and overwhelming. However, a growing trend sees small businesses turning to specialized firms for their accounting needs.

In this article, we explore the key reasons why outsourcing accounting services is becoming a strategic necessity for small businesses. We’ll delve into how this practice offers cost-efficiency, access to expert knowledge, and the valuable freedom to focus on core business activities.

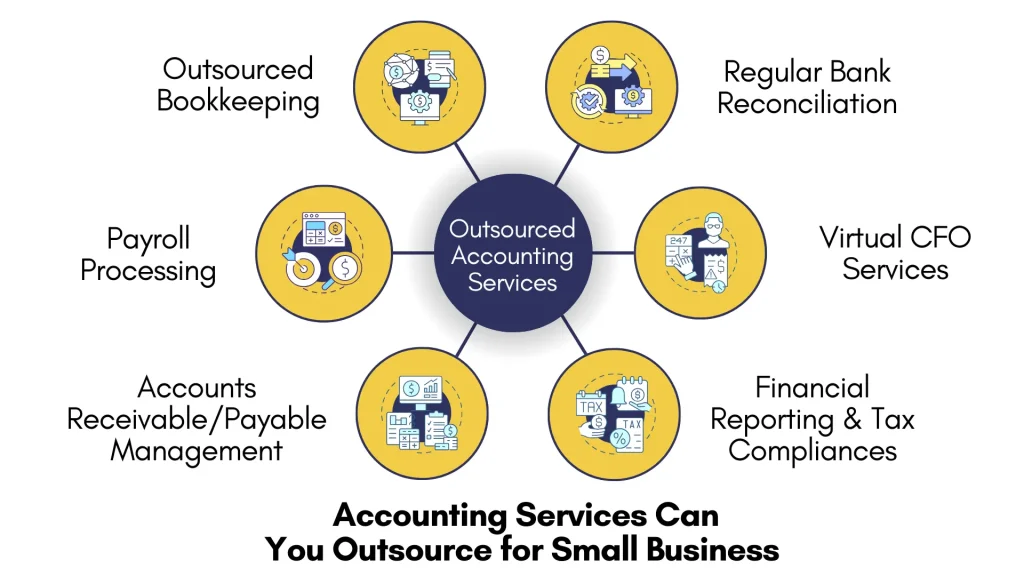

Accounting Services You can Outsource for Small Business

In the complex landscape of small business competition, every resource is precious and every decision carries significant weight. Managing finances within this dynamic environment often presents a complex challenge. From solving complicated tax laws to maintaining accurate records, the demands of financial management can overcome even the most experienced entrepreneurs.

However, to overcome these challenges, a transformative solution appears as outsourcing accounting services for small businesses. Through collaboration with specialized firms, small businesses gain access to a bunch of benefits, ranging from cost efficiency to enhanced accuracy and strategic insights.

This in-depth exploration delves into the compelling reasons why outsourcing accounting services has become a strategic imperative for small businesses. We’ll explore the diverse range of services offered and highlight the concrete advantages they provide in driving businesses toward success.

The Accounting Services Can You Outsource for Small Business

Outsourced Bookkeeping

Bookkeeping forms the foundation of financial management, involving the recording and organization of daily transactions. Outsourcing bookkeeping services allows small businesses to maintain accurate records without the burden of hiring and training in-house staff. Professional bookkeeping firms use advanced software and processes to ensure meticulous record-keeping, providing businesses with reliable financial data for informed decision-making.

With our comprehensive expertise in Outsourced Bookkeeping, we’re committed to streamlining your Financial management with Premium solutions. If you have any inquiries, please visit our website or reach out to us directly at Whatsapp at +19295603456 or via email at info@cridix.com

Payroll Processing

Managing payroll is a critical yet time-consuming task for small businesses. Outsourcing payroll processing services enables businesses to ensure timely and accurate payment of wages, taxes, and benefits while staying compliant with regulations. Professional payroll providers handle tasks such as calculating employee wages, deducting taxes, and generating paychecks, freeing up valuable time for business owners to focus on strategic priorities.

Accounts Receivable/Payable

Outsourcing Accounts Payable services allow businesses to streamline their payment processes, improve efficiency, and minimize errors. Professional firms employ automated systems and efficient workflows to process invoices accurately and ensure timely payments to vendors.

Similarly, Outsourcing Accounts Receivable services enables businesses to optimize their collections process, reduce payment delays, and improve cash flow. Professional receivables management firms utilize proven strategies to track receivables, follow up on overdue invoices, and negotiate payment terms with customers.

Cash Flow Management

Cash flow management is essential for the financial health of small businesses, and outsourcing this critical function can offer significant benefits. Professional firms can provide expertise in monitoring cash flow, analyzing trends, and implementing strategies to optimize cash flow cycles. By outsourcing cash flow management, businesses can gain access to real-time financial insights and proactive solutions to address cash flow challenges.

Invoice Management

Outsourcing invoice management involves hiring experts to handle sending and tracking invoices. This helps businesses ensure invoices are processed efficiently and payments are received on time. By outsourcing this task, businesses can streamline their billing processes, reduce administrative work, and improve cash flow. Overall, outsourcing invoice management provides small businesses with a reliable solution to handle invoicing needs while focusing on core operations and growth.

Bank Reconciliation

Bank Reconciliation is to match a business’s financial records with bank statements to ensure accuracy. This helps businesses identify differences, errors, or fraudulent activities efficiently. By outsourcing this task, businesses can streamline their reconciliation process, reduce the risk of financial errors, and ensure compliance with banking regulations.

Virtual CFO Services

Outsourcing virtual CFO services means hiring experienced financial professionals to provide strategic guidance and financial management. Cridix professionals help businesses develop long-term financial strategies, manage cash flow, and navigate complex financial challenges. By outsourcing virtual CFO services, businesses can access expert financial advice without the expense of hiring a full-time CFO.

financial reporting

Generating accurate financial reports is essential for monitoring business performance and making informed decisions. Outsourcing financial reporting services allows small businesses to access specialized expertise in preparing income statements, balance sheets, and cash flow statements. Professional accounting firms utilize advanced analytics tools to analyze financial data and provide actionable insights for improving business operations and profitability.

Tax Preparation and Compliance

Navigating complex tax regulations can be challenging for small businesses. Outsourcing tax preparation and compliance services offers expert assistance in preparing and filing tax returns, ensuring compliance with ever-changing tax laws, and maximizing tax-saving opportunities. Professional tax advisors help businesses minimize tax liabilities while avoiding costly penalties and audits, providing peace of mind during tax season.

5 Benefits of Outsourcing Accounting Services

In this competitive world of small business operations, managing finances is a critical aspect that requires attention to detail and expertise. Outsourcing accounting services has appeared as a strategic solution for small businesses seeking to streamline operations, reduce costs, and enhance overall efficiency. In this comprehensive section, we delve into the various benefits of outsourcing accounting services for small businesses, exploring how this approach can empower small businesses to achieve financial success with confidence and precision.

Benefits of Outsourcing Accounting Services for Small Business

Cost Savings

One of the primary reasons small businesses opt for outsourcing accounting services is the potential for significant cost savings. By outsourcing, businesses can avoid the overhead costs associated with hiring and training full-time accounting staff, as well as the expenses related to maintaining accounting software and infrastructure. Additionally, outsourcing allows businesses to pay only for the services they need, providing flexibility and scalability as their financial needs evolve.

Access to Expertise

The most compelling advantage of outsourcing accounting services is the access to specialized expertise that it provides. Accounting firms employ professionals with in-depth knowledge and experience in various areas of accounting, tax, and financial management. These experts can offer valuable insights, identify opportunities for cost reduction and revenue growth, and ensure compliance with ever-changing regulations.

Flexibility

As small businesses grow and evolve, their financial needs may change accordingly. Outsourcing accounting services provides the flexibility to scale up or down as needed, without the constraints of hiring or training new employees.

Enhanced Accuracy

Professional accounting firms always offer standards of accuracy and compliance, minimizing the risk of errors, discrepancies, and regulatory penalties. By outsourcing accounting services, small businesses can guarantee that their financial records are in capable hands.

Time-Effective

Outsourcing accounting services saves small businesses time by streamlining processes with efficient technology and expertise, enabling faster completion of tasks like bookkeeping and tax preparation. It allows owners and staff to focus on core activities, such as marketing and customer service, while ensuring timely financial reporting and compliance with regulations.

Get Premium Outsourced Accounting From Cridix Accountancy

Experience Premium Outsourced Accounting Services with Cridix Accountancy, where expertise meets efficiency. Our dedicated team of professionals ensures meticulous Financial Management, from Regular Bookkeeping to Tax preparation, tailored to your business needs. With Advanced Technology and streamlined processes, we provide Timely and Accurate Reporting, allowing you to focus on driving your business forward. Trust Cridix Accountancy to deliver exceptional service and strategic guidance, empowering your business to thrive in today’s competitive landscape.

Why Choose Cridix Accountancy?

Streamline Your Small Business

Financial Management with Cridix Premium Solutions

Final Words

So, Outsourced accounting services offer small businesses a strategic advantage in managing their finances effectively and driving growth. By leveraging the expertise and resources of specialized firms, businesses can streamline operations, reduce costs, and enhance overall efficiency.

Outsourcing accounting tasks allows businesses to access professional expertise, ensure compliance with regulations, and receive strategic guidance without the burden of maintaining an in-house accounting department. With time-saving benefits, scalability, and access to specialized expertise, outsourced accounting services provide small businesses with a reliable solution.