Whether you’re a seasoned investor or a budding real estate agent, keeping your finances organized is crucial for success. Real estate accounting and bookkeeping are the cornerstones of financial health, providing insights to make informed decisions and ensure tax compliance. This guide equips you with the knowledge and steps to navigate the world of real estate finance.

Real estate Accounting and bookkeeping are related but distinct practices in business management. Accounting involves analyzing, recording, and reporting a business’s financial information. This includes creating budgets, studying financial trends, and evaluating strategies to increase profits or reduce expenses.

In contrast, bookkeeping focuses on accurately tracking transactions and keeping records up to date. Bookkeepers record all purchases, sales, payments, and receipts to provide an accurate financial snapshot of the company at any given time. While accountants may perform some bookkeeping tasks, they primarily focus on data analysis rather than just entering numbers into accounts.

While often used interchangeably, accounting is the financial analysis and strategic decision-making based on bookkeeping data. Bookkeeping focuses on the day-to-day recording of financial transactions.

Real Estate Accounting and Bookkeeping

In the dynamic world of real estate, robust Real estate accounting and bookkeeping practices are the cornerstones of success. They empower you to track income and expenses, understand your profitability, and make informed decisions. Let’s explore how these principles translate into practical actions for real estate professionals.

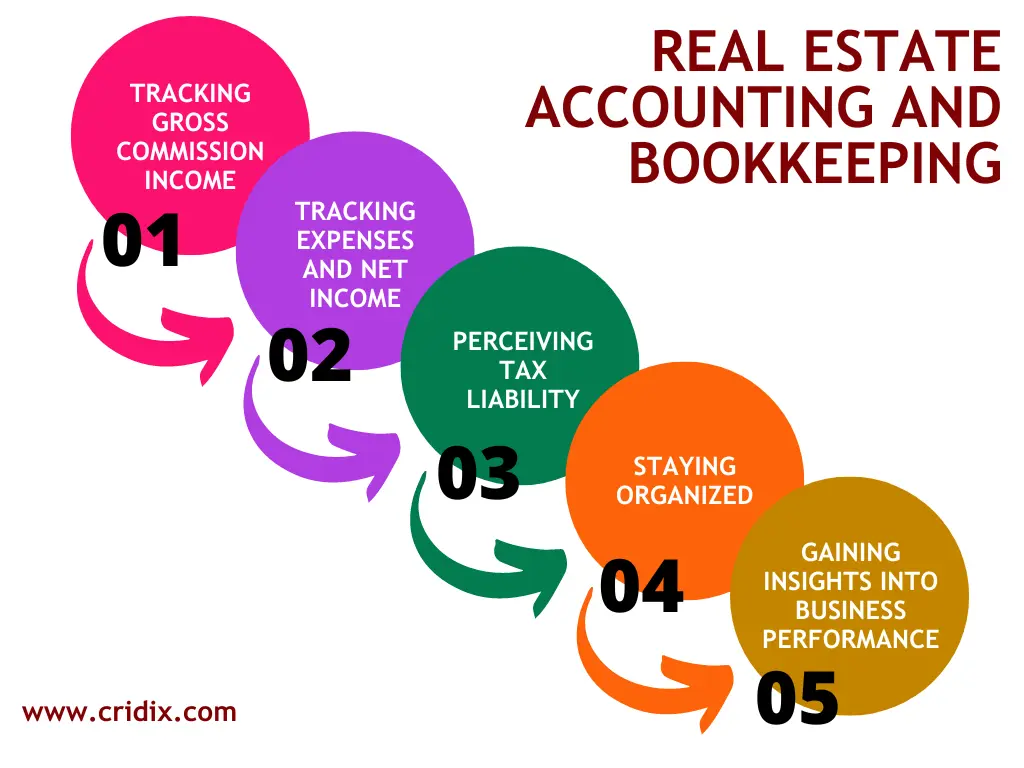

Steps to follow in Real Estate Accounting and Bookkeeping:

Tracking Gross Commission Income

Record Every Commission: Whether you close a single-family home deal or a commercial property transaction, meticulously record every commission earned. Include details like the property address, selling price, your commission rate, and the date the commission is earned (typically at closing).

Categorize Commissions: Consider separating commissions into categories like residential sales, commercial sales, or property management fees. This facilitates performance analysis by property type or service offered.

Accounting Method Matters: Cash accounting reflects commissions when received, while accrual accounting recognizes them when earned (even if not received yet). Choose the method that best suits your business size and tax strategy.

Tracking Expenses and Net Income

Categorize Expenses: Organize your expenses into meaningful categories like marketing, professional development, property management, and car expenses. This allows you to identify areas for potential cost reduction and analyze spending patterns.

Calculate Net Income: Once you’ve tracked your gross commissions and expenses, subtract the total expenses from your total commissions to arrive at your net income (profit). This number reflects the true profitability of your real estate business.

Capture All Expenses: Every expense related to your real estate business needs to be tracked. This includes marketing costs, continuing education fees, subscriptions to real estate platforms, travel expenses for property showings, and even home office supplies.

Understanding Projected Tax Liability

Track Tax-Deductible Expenses: Many real estate business expenses are tax-deductible. Examples include car mileage driven for business purposes, professional association dues, and marketing materials. Consult a tax advisor to identify all deductible expenses.

Accounting Software Advantage: Utilize accounting software designed for real estate professionals. These programs often have features that categorize transactions according to tax implications, simplifying tax estimation.

Estimate Tax Payments: Based on your projected net income and tax deductions, estimate your quarterly tax payments throughout the year. This helps avoid penalties for underpayment of taxes.

Gaining Insights into Business Performance

Financial Reports: Generate regular reports that summarize your income, expenses, and net income. Analyze trends over time to identify areas where you’re excelling and areas needing improvement.

Key Performance Indicators (KPIs): Track key performance indicators (KPIs) relevant to real estate professionals. Examples include conversion rates (leads converted to clients), average commission per transaction, and number of properties listed/sold. Monitoring KPIs helps you measure your effectiveness and identify areas for improvement.

Benchmarking: Compare your performance metrics against industry benchmarks or your own historical data. This provides valuable insights into your competitive standing and growth trajectory.

Staying Organized

Dedicated Business Accounts: Maintain separate bank accounts and credit cards for your real estate business. This simplifies bookkeeping and avoids commingling personal and business finances.

Cloud-Based Accounting: Consider using cloud-based accounting software. These programs offer secure data storage, and accessibility from any device, and often integrate with bank accounts and credit cards for automatic transaction downloads, saving you time and minimizing data entry errors.

Digital Receipts: Invest in a receipt scanning app or utilize accounting software features that allow you to capture digital copies of receipts for expense tracking.

Start Improving Your Real Estate Accounting Processes

Real estate accounting is crucial for running a successful business in the real estate industry. Ensuring accurate and compliant bookkeeping practices helps prevent legal issues and financial losses. Key steps include regular audits, precise reporting procedures, maintaining separate records, understanding local requirements, backing up files and data, categorizing expenses correctly, and maintaining clear communication with all stakeholders. With proper care and preparation, real estate accounting can be more straightforward than it initially seems.

How can we help?

Our Real Estate Accounting and Bookkeeping can streamline your business. We’ll handle meticulous expense tracking, ensure accurate commission recording, and generate insightful financial reports. This empowers you to focus on what matters most – closing deals and growing your real estate empire. Let us navigate the complexities of real estate accounting, so you can stay organized, make data-driven decisions, and maximize your profitability.

Whether you require assistance with tax compliance, financial reporting, payroll processing, or strategic financial planning, I can help you streamline your financial operations and make informed decisions to ensure your real estate business thrives. Don’t hesitate to Schedule a Free Meeting to discuss how my expertise can empower your success in this exciting business environment.