Introduction

In the ever-evolving landscape of financial management tools, Wave Accounting Software continues to stand out as a prominent solution, offering businesses a comprehensive suite of features to streamline their accounting processes.

For entrepreneurs running small businesses, handling finances and facing various responsibilities can be challenging. The complexity of accounting software only adds to the stress. Thankfully, simplified solutions like Wave Accounting ease this burden by providing an uncomplicated way to track both income and expenses.

Want to Grow Your Small Business

If you are not familiar with Wave accounting then schedule a meeting with us so that we can handle your small business.

Have a question? Call us on

+1 (929) 560-3456

5 Early Warning Signs In Your Accounts Receivable Management

In this review of 2025, we will explore the key features that make Wave Accounting Software a unique choice for entrepreneurs and small businesses. Additionally, we will delve into its pricing structure, providing insights into the value it brings to various user categories.

To ensure a well-rounded perspective, we will also examine alternative accounting solutions that merit consideration in the dynamic realm of financial software. Join us as we guide you through the complex details of Wave Accounting Software, assigning you the knowledge to make informed decisions for your business’s financial management needs.

What is Wave Accounting?

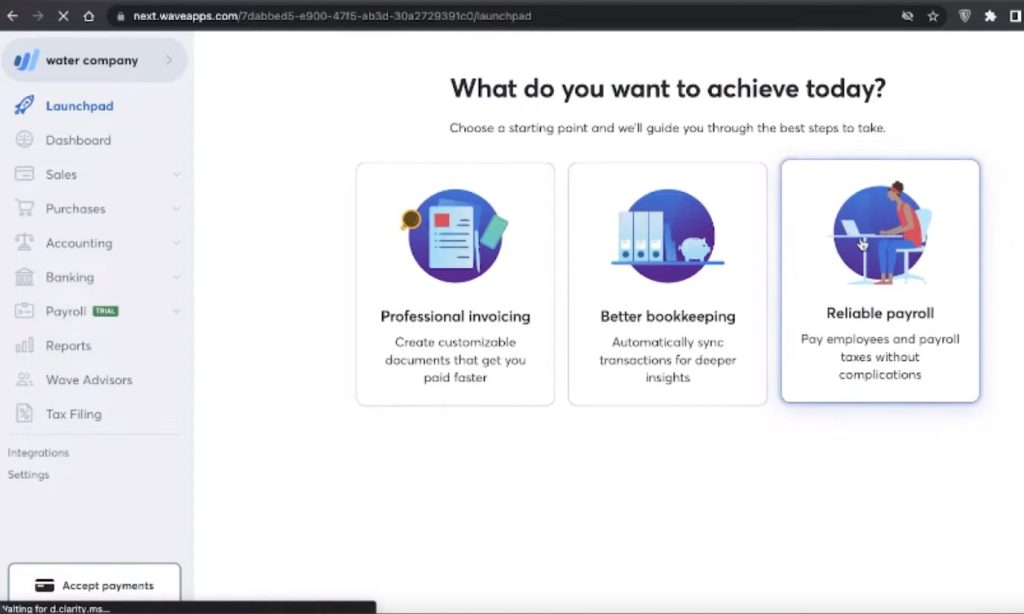

Wave Accounting is a cloud-based accounting software designed for small businesses and entrepreneurs. It offers a range of financial management tools to streamline tasks such as invoicing, expense tracking, and reporting. One of the notable features of Wave is its user-friendly interface, making it accessible to individuals with limited accounting knowledge.

Wave Accounting is particularly popular for its free accounting and invoicing services, providing essential tools without subscription costs. Additionally, it integrates with banking and payment platforms, allowing users to manage their financial activities more efficiently.

Overall, Wave Accounting aims to simplify the accounting process for small businesses, enabling them to focus on core operations without the complexities often associated with financial management.

Key Features of Wave Accounting Software

Wave Accounting stands out as a widely used accounting and bookkeeping software designed specifically for small businesses. The platform offers a suite of tools that enable users to track income, manage expenses, generate detailed financial reports, and handle invoicing and payments. Famous for its user-friendly interface and comprehensive feature set, Wave Accounting has earned a reputation as a trusted solution for streamlining and enhancing the efficiency of financial management processes for small businesses.

Here are some Key Features of Wave Accounting Software

Cridix Accountancy has been offering accounts receivable outsourcing services for many years. Through our extensive experience, we’ve identified various indicators of poor accounts receivable (A/R) management that companies can recognize to enhance their financial well-being.

Bookkeeping Feature

If you seek a reliable tool for monitoring your financial transactions, Wave’s bookkeeping features are sure to meet your needs. Achieving an ideal 10/10 rating in our research within this category, it competes directly with leading accounting platforms such as QuickBooks and Xero. The wave must provide an extensive array of bookkeeping functionalities containing journal entries, bank reconciliation statements, customizable charts of accounts, and balance sheets.

Best Free Cloud Accounting Software for Canada & USA

Invoice Management

One of the standout features of Wave Accounting is its strong invoicing capabilities. Users can create professional and customizable invoices, maintaining a consistent brand identity. The platform facilitates direct sending of invoices to clients, expediting the billing process and ensuring timely payments. Furthermore, the real-time status tracking feature enables businesses to monitor when invoices are viewed and paid, enhancing transparency in the invoicing cycle.

Expense & Income Tracking

Wave goes above and beyond for a free accounting tool by letting you track your income and expenses without any limits. You can easily connect your bank accounts, import statements, and add expenses manually. What’s really cool is that Wave allows you to categorize lots of transactions at once and merge any duplicate ones. This makes everything way more straightforward and organized for managing your money.

Users can easily record and categorize business expenses, gaining clarity on where funds are assigned. The platform supports the attachment of receipts through image uploads, facilitating a digital record-keeping system. Additionally, Wave’s spending investigation tools empower businesses to make informed financial decisions.

Accounts Payable & Receivable Management

The tool enables users to monitor bills and expenses, log payments in various currencies, and scan bills. However, in contrast to QuickBooks and Zoho Books, businesses utilizing this software are unable to establish regular bills or generate purchase orders, posing challenges for automated financial management.

Wave helps in simplifying the process of tracking money owed with its accounts receivable features. Users can effectively manage overdue client payments, generate and dispatch invoices and estimates, establish recurring invoices, and schedule payment reminders. What sets Wave apart is its ability to store detailed client information in comprehensive customer profiles, providing users with easy access to a wealth of important data all within a user-friendly dashboard. Wave’s provides free comprehensive accounts receivable functionality streamlines financial tracking and enhances user experience.

Seek Professional Guidance

While Wave’s bookkeeping offers a comprehensive set of accounting tools, it’s necessary to highlight the importance of consulting with a professional accountant or bookkeeper. Seeking guidance from a financial expert ensures personalized advice and compliance with relevant laws and regulations.

Wave accounting software stands out as a trustworthy and user-friendly solution crafted for small businesses and entrepreneurs. For further details on the advantages of Wave Bookkeeping, feel free to contact Cridix Accountancy.

Pricing Plan for Wave Software

Wave accounting software offers various types of services, which some are free and some are accessible only to paid users. Here we discuss in detail what type of features are available to free users and also we examine that what will be pricing plan of wave accounting software for premium users.

Features of Free Plan

This plan includes all of the basic accounting and invoicing features that you need to run a small business, such as:

Features of Paid Plans

Wave offers two paid plans (Wave Payroll & Wave Advisor) that add additional features, such as:

Wave Accounting Pricing Table

Free Plan

Wave Payroll

Wave Advisors

Alternatives of Wave Accounting

Several accounting software alternatives offer varying features and suitability for different business needs. Here are some other options for Wave Accounting:

QuickBooks

Sage Cloud Accounting

FreshBooks

Lendio

Explore more about our E-Commerce Bookkeeping Services that we did using various Cloud Bookkeeping Software like Xero, Quickbooks, ZohoBooks, and Cloudbooks, etc.

Conclusion

To sum it up, Wave Accounting Software will prove to be a great choice for small businesses and entrepreneurs in 2025. With its user-friendly features like easy tracking of money, creating invoices, and even accepting payments online (with a small fee), Wave simplifies financial tasks. The fact that it offers free accounting and invoicing services adds extra appeal.

However, keep in mind that there are other options like QuickBooks and Xero, so it’s a good idea to explore different software based on what your business specifically needs. As technology keeps advancing, choosing the right accounting tool can make managing finances much smoother for your business.

If you seek assistance in enhancing your accounting and bookkeeping management, consider outsourcing services from Cridix Accountancy. Our skilled team is ready to enhance the financial well-being of your business. For more information, reach out to us via email at info@cridix.com or give us a call or WhatsApp at +1(929)5603456.