Malta is one of the fastest-growing economies within the European Union, attracting entrepreneurs and investors with its favorable business environment. Recognized for its scenic landscapes and temperate climate, the island nation offers a scope of advantages for future business owners, including immigration opportunities, economic stability, and fiscal incentives.

Despite its modest size, Malta’s diversified economy presents vast opportunities to access a diverse target market. Since the 1950s, the Maltese government has actively encouraged investment and entrepreneurship, fostering economic expansion and employment growth. With a population exceeding 400,000 and over 1.2 million annual tourists, Malta offers a productive ground for business promotion.

However, navigating the regulatory landscape of a foreign jurisdiction demands a comprehensive understanding of local laws and regulations. This guide provides valuable insights into establishing and operating a business in Malta, equipping entrepreneurs with essential knowledge for success.

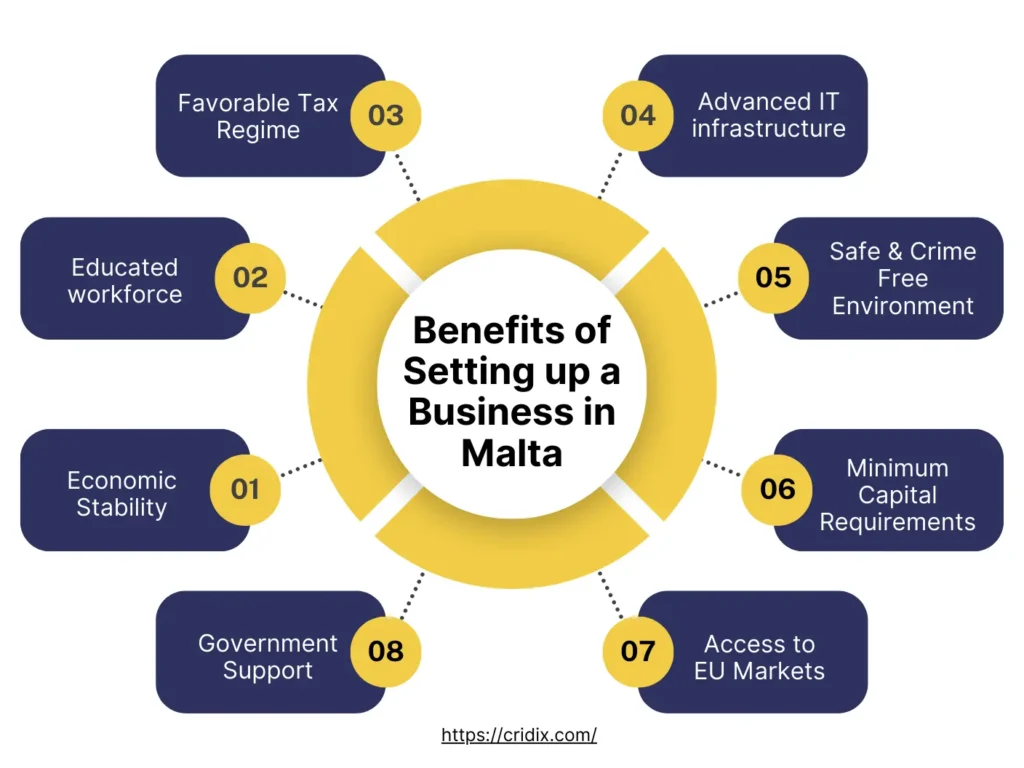

Benefits of Setting up a Business in Malta

Business in Malta is varied, thriving, and profitable. It has not been easy to achieve this during economic challenges that have plagued other nations in recent years. Despite obstacles, the island has navigated through adversity and emerged stronger. Several key factors have contributed to this favorable business climate.

Malta has some of the most favorable business legislation and taxation policies in Europe, including a low effective corporate tax rate. These advantages make it a compelling destination for foreign investors seeking to establish a business. In this article, we explore eight key benefits of setting up a business in Malta, providing valuable insights to assist individuals in determining whether registering a company in Malta is the right choice for them.

Here are some top benefits of setting up a Business in Malta:

Economic Stability

Malta has a strong and reliable banking system, establishing itself as a premier financial services center in Europe. This attractive destination offers innovative fund structures to cater to businesses and startups, including Professional Investor Funds, Alternative Investment Funds, Private Funds, and UCITS.

Looking to expand? Foreign investors, regardless of company size, can benefit from a range of supportive schemes. These include Business Advisory Services, Micro Invest, Business START, and Development and Research Grant Schemes, all designed to fuel business growth.

Malta’s economic performance is equally impressive. With a remarkable 10.3% annual growth rate in 2021, the country’s GDP reached a staggering $17.36 billion. Furthermore, Malta has a proven track record of weathering economic storms, maintaining a strong credit rating (above ‘A’) in recent years.

Advanced IT infrastructure

Malta isn’t just a beautiful island nation; it’s a hub buzzing with cutting-edge technology. Businesses can leverage a highly developed IT infrastructure, ensuring a robust foundation for their operations. Malta is a reliable and high-speed internet network, crucial for seamless data transfer, communication, and cloud-based applications.

A powerful IT infrastructure helps minimize downtime and ensures business continuity in case of technical glitches. Easy access to advanced technologies fosters innovation and empowers businesses to explore new digital solutions for growth. Strong IT infrastructure positions Malta as an attractive destination for tech-savvy talent, making it easier for businesses to find skilled workers.

Educated workforce

Malta offers a winning combination for businesses: a highly skilled and educated workforce at a competitive cost. The country’s excellent education system fosters a pool of talented professionals, yet the cost of living remains lower compared to other EU nations. This translates to potentially lower salaries (as evidenced by the minimum wage of €785) compared to your European neighbors. Additionally, Malta’s multilingual workforce equips your company to expand globally and reach new markets with ease.

Access to EU Markets

Setting up a Business in Malta grants you instant access to the massive European Union market. This seamless movement of goods and services across member states eliminates trade barriers and customs delays.

With a population exceeding 450 million, the EU offers a vast customer base for your products or services, while standardized regulations simplify compliance across member countries. This EU membership not only enhances your company’s credibility but also positions you strategically to tap into neighboring regions in North Africa and the Middle East.

Minimum Capital Requirements

Entrepreneurs eyeing Europe as their business goal will find Malta especially welcoming, thanks to its low minimum capital requirements. Unlike many European countries, Malta permits businesses to register as a Limited Liability Company (LLC) with a minimum investment of just €1,165. This significantly lowers the financial hurdle, making it easier for startups and innovative ventures to kickstart their journey.

Consequently, this creates a more vibrant business ecosystem, allowing a wider array of entrepreneurs and companies to take part. The reduced capital requirement encourages risk-taking and fosters innovation, paving the way for new ideas and businesses to thrive in Malta’s fertile landscape. However, it’s crucial to note that a well-crafted business plan and adequate funding beyond the minimum capital are essential for ensuring long-term success.

Safe Environment with low crime

Malta offers a significant advantage for businesses seeking a secure and stable environment to operate in. The country has a very low crime rate, fostering peace of mind and minimizing potential disruptions.

A lower crime rate can lead to reduced security needs for businesses, allowing them to allocate resources toward core operations. Operating in a secure location can positively impact your company’s image and attract investors and customers seeking stability. A safe working environment contributes to a happier and more productive workforce.

Favorable Tax Regime

Malta is well-known for its exceptionally low, and corporative taxes within the European Union. The standard taxation rate in Malta stands at 35% of the company’s chargeable income. Nevertheless, shareholders of the company are eligible for a tax refund equivalent to the amount paid by the company. This is attributable to Malta’s full-imputation system of corporate taxation, wherein the income tax paid by a company in Malta is credited to the shareholder upon receiving dividends. As a result, the effective tax rate plummets to approximately 5-7% through profit distribution to the holding company.

Moreover, as a resident of Malta, you are only obligated to pay taxes on income remitted to Malta. However, it’s important to note that the refund may be curtailed if double taxation relief is claimed under specific circumstances. Hence, the allure of low taxation rates stands out as one of the key advantages of establishing a business in Malta.

Top Business Opportunities in Malta

Malta, a small yet promising country, emerges as an optimal location for initiating experiences and an attractive destination for U.S. citizens considering relocation. With a burgeoning reputation in Europe, Malta continues to attract increasing international investments. The island’s charm lies in its various opportunities for aspiring entrepreneurs, making it an enticing possibility for those eager to establish their enterprises in this dynamic location.

Emerging Sectors:

Areas with Potential:

Company Registration Process in Malta

Malta’s thriving business environment attracts entrepreneurs worldwide. If you’re ready to join the ranks of successful companies operating on this beautiful island nation, here’s a breakdown of the key steps involved in registering your business:pen_spark

How can we help?

As a Premium Accountant with extensive experience in the Maltese business landscape, I understand the difficulties of navigating financial regulations and maximizing your company’s growth potential. Cridix Accountancy provides a comprehensive suite of Bookkeeping and Accounting Services specifically tailored to the needs of businesses operating in Malta.

Whether you require assistance with tax compliance, financial reporting, payroll processing, or strategic financial planning, I can help you streamline your financial operations and make informed decisions to ensure your business thrives in Malta. Don’t hesitate to Schedule a Free Meeting to discuss how my expertise can empower your success in this exciting business environment.