Introduction to eCommerce Accounting

Managing finances is a key responsibility for e-commerce business owners. Accounting helps meticulously track all financial transactions, enabling informed decision-making based on reliable financial data.

Additionally, we’ll cover the fundamental steps required to initiate e-commerce Accounting, including selecting an appropriate accounting method, opting for suitable software, and effectively organizing receipts and invoices.

eCommerce Accounting Services with Cridix

Cridix specializes in eCommerce accounting services, our expert team ensures accurate bookkeeping, tax compliance, and financial optimization, empowering eCommerce owners to focus on growth.

Furthermore, we’ll discuss the strategies for streamlined e-commerce bookkeeping in 2025, managing overall challenges you may encounter and exploring emerging trends in this domain. Whether you’re a seasoned e-commerce seller or embarking on your journey, this blog post encompasses comprehensive insights into e-commerce Accounting and Bookkeeping, essential for fostering business growth.

Importance of Accounting for E-commerce

Accounting plays a vital role in the operations of eCommerce businesses for several reasons. Firstly, it acts as the foundation for effective financial management, enabling businesses to accurately monitor their revenue, expenses, and overall financial well-being.

Also, Accounting is vital for ensuring compliance with tax regulations and financial reporting standards. With accurate accounting records, eCommerce businesses can meet their tax obligations, such as sales tax, income tax, and VAT (Value Added Tax), while also preparing financial statements in alignment with relevant accounting principles.

With Cridix, eCommerce entrepreneurs can streamline their financial operations, ensuring Accuracy, Compliance, and Efficiency.

Accounting serves as a cornerstone for eCommerce businesses by facilitating financial management, ensuring regulatory compliance, and guiding strategic decision-making processes. Ultimately, it fosters efficiency, profitability, and sustainable growth within the eCommerce landscape.

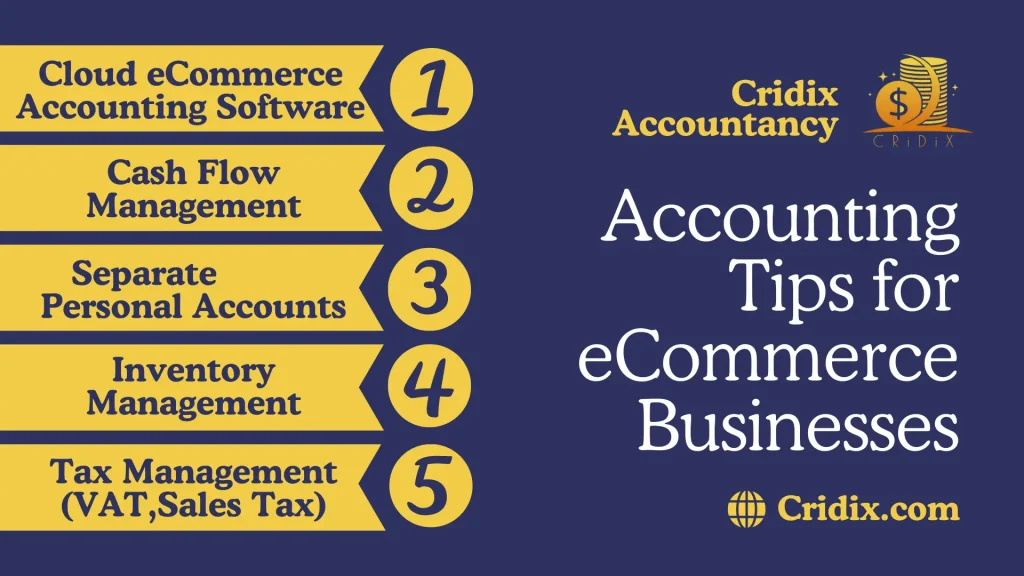

Accounting Tips for eCommerce Business

Over the course of their existence, ecommerce businesses often accumulate numerous small details, and without diligent bookkeeping, managing these details can become increasingly burdensome and complex. Effective bookkeeping ensures that individuals are aware of the flow of cash in and out of their business. This awareness empowers small businesses to make informed decisions. Here are some key considerations to keep in mind when serving as your own ecommerce bookkeeper:

Effective financial management is essential for eCommerce success. Separate business and personal finances to maintain clarity and organization. Utilize cloud-based accounting software like QuickBooks Online for streamlined processes and real-time insights. Implement inventory management systems to track product levels accurately.

Cloud Accounting Software

Numerous eCommerce accounting software platforms are available for purchase, and it’s advisable to leverage their free trials to experiment and determine which platform best suits your business needs. Many of the leading providers, along with most banking apps, offer seamless and secure integration with your platform, ensuring that all transactions flow effortlessly.

Cloud accounting software simplifies eCommerce Accounting and Bookkeeping in several ways:

Premium eCommerce Accounting & Bookkeeping Services

In short, cloud accounting software makes eCommerce accounting and bookkeeping easier by giving you access to your finances anytime, automating repetitive tasks, and keeping your data secure. It’s a valuable tool for any eCommerce business looking to streamline its financial operations and focus on growth.

Cash Flow Management

It’s essential to review your business’s chart of accounts, which contains both cash inflow (e.g., sales income statement) and outflow (e.g., overhead and operating expenses). At the end of each tracking period, you should be able to easily reconcile your credits and debits in your balance sheet. Transparency is key, ensuring that your cash flow statement and balance sheet are clear and comprehensible.

Cash flow management is necessary for the financial health and sustainability of eCommerce businesses. By ensuring that you have sufficient cash on hand to meet your responsibilities, manage working capital efficiently, and seize growth opportunities, you can position your business for long-term success in the competitive eCommerce landscape.

Separate Personal Accounts

Maintaining separate bank accounts for your business and personal finances is highly recommended. By having a dedicated account for your business, you can effectively manage its finances with greater ease and clarity. This separation helps ensure better control and organization of your business’s financial transactions.

Golden Rule: Always Make sure that you do not use money from your business account for your personal needs.

When you’re opening a business bank account, take your time to shop around and find the best fit for your needs. Consider things like fees, any special offers, and whether you can easily manage your account online. Doing your research upfront will help you avoid expensive surprises later on.

Inventory Management

Developing a well-organized eCommerce inventory management system is crucial for running a successful business. While it may involve detailed processes, having full visibility of every aspect helps you stay prepared for unexpected challenges.

Effective eCommerce inventory management streamlines the sourcing, storage, tracking, and shipping of your business’s inventory, making the entire process more efficient and manageable. Implementing robust inventory management strategies can help eCommerce companies enhance their efficiency and lower operational costs.

8 Best Ways to Manage Small Business Financial Management

Your inventory practices should specify the optimal amount of inventory to maintain at any given time. Making incorrect decisions about inventory management can be costly, but making the right choices can lead to significant profitability.

Tax Management (VAT)

E-commerce businesses must be mindful of their VAT obligations. If your e-commerce turnover exceeds £85,000 annually, VAT registration is mandatory. However, even if you fall below this threshold, voluntary registration can have advantages.

Ensure you charge the correct VAT rate for applicable sales. Different products and services may attract varying VAT rates, including zero-rated and exempt items. Submit VAT returns to HMRC regularly, accurately reflecting both the VAT collected and paid. This necessitates meticulous bookkeeping of all VAT transactions.

What are the Benefits Of Hiring an Accountant?

For e-commerce businesses registered as limited companies, remember to pay corporation tax on your profits. Keep precise financial records to calculate your tax accurately. If you’re a sole trader or in a partnership, make sure to separate your personal and business income. Clear records will help you calculate your income tax correctly.

And if you have employees, don’t forget about payroll taxes. Deduct income tax and National Insurance contributions accurately and report them on time.

Reconciliation & Financial Statements

Regular reconciliation and financial reporting play a crucial role in maintaining a healthy financial situation. Make sure to reconcile your financial records with your bank statements regularly and double-check for any mistakes. This monthly practice helps identify and correct errors promptly.

Generate and review monthly financial reports to understand your business’s performance better. Tools like profit and loss statements provide valuable insights that can guide decision-making.

For tax purposes, prepare annual financial statements. These include documents such as balance sheets, income statements, and cash flow statements, which are essential for accurate tax reporting.

Outsourced eCommerce Accounting Services

About Cridix Accountancy

Cridix is an Accountancy firm that provides automated accounting services for e-commerce businesses. Our system connects to your apps, syncs all your data, and keeps your books updated in real-time, saving you the hassle of manual bookkeeping. You get 24/7 access to reconciled books, helpful tax-saving tips, and a single hub for all your financial info.

Why Choose Cridix Accountancy for eCommerce Accounitng & Bookkeeping Services?

Choose our eCommerce accounting services to experience the premiu and take your online business to new heights of success.

From Sales to Balance Sheets: Tailored Accounting & Bookkeeping Solutions for your eCommerce Business

Conclusion

In summary, maintaining proper bookkeeping is essential for the prosperity of your e-commerce business. It keeps you organized, empowers you to make well-informed financial choices, and ensures adherence to tax regulations. As the e-commerce landscape continues to grow, it’s important to grasp the distinct nuances of bookkeeping for various platforms such as Amazon and Shopify.

Implementing effective accounting practices is vital for the success of eCommerce businesses. By following these tips, such as separating business and personal finances, utilizing cloud accounting software, and managing cash flow efficiently, eCommerce entrepreneurs can streamline their financial operations and make informed decisions.

With the right accounting strategies in place, eCommerce businesses can navigate challenges, grab opportunities for growth, and achieve long-term success in the dynamic online eCommerce marketplace.

With our extensive expertise in eCommerce Accounting and Bookkeeping, we’re committed to fulfilling your requirements. If you have any further inquiries, please visit our website or reach out to us directly at Whatsapp +19295603456 or via email at info@cridix.com.